Life insurance is a cornerstone of financial planning, offering peace of mind that your loved ones will be financially secure after you’re gone. However, many are unaware that life insurance proceeds can be significantly reduced by estate taxes, leaving less for your family than you planned. This is where an Irrevocable Life Insurance Trust (ILIT) comes into play, offering a strategic solution to this issue.

Understanding the Impact of Estate Taxes on Life Insurance

When you pass away, the proceeds from your life insurance are often subject to federal estate taxes, and in some cases, state estate taxes. This taxation can claim up to 40% of your life insurance benefits, a substantial amount that you intended for your family’s financial security. The key to mitigating this is understanding how ownership affects estate taxes.

The Role of Ownership in Estate Taxation

The crux of the matter lies in ownership. Estate tax is levied on property that you own at the time of your death. Therefore, if you don’t own your life insurance policy, the proceeds are generally exempt from this tax. This leads to a critical question: if not you, then who should own your life insurance policy? The answer for many is an ILIT.

What is an ILIT?

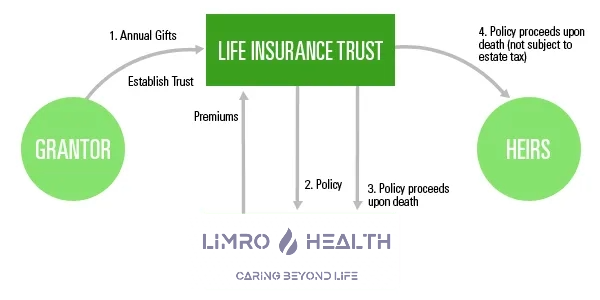

An ILIT is a trust specifically created to hold life insurance policies. Its primary purpose is to exclude life insurance proceeds from federal estate tax. When set up and funded correctly, it ensures that your beneficiaries receive the full amount of your life insurance, unaffected by estate tax.

How Does an ILIT Work?

An ILIT is an irrevocable trust, meaning once established, its terms cannot be altered. This trust becomes the owner of your life insurance policy. You then designate the ILIT as the beneficiary of the policy, and in turn, your family members are named as beneficiaries of the ILIT. This arrangement ensures that the life insurance proceeds do not become part of your taxable estate.

Setting Up an ILIT

Creating an ILIT requires careful drafting and execution, typically involving an experienced attorney. While there are upfront costs, the potential savings in estate taxes are significant. A Limro Health consultant can help

Choosing a Trustee for Your ILIT

Selecting a trustee for your ILIT is a crucial decision. The trustee should be someone other than yourself or your spouse to avoid the life insurance proceeds being included in your estate. Often, a professional trustee, like a bank or trust company, is a wise choice.

Funding Your ILIT

There are two ways to fund an ILIT:

- Transfer an Existing Policy: You can transfer your current life insurance policy to the ILIT. However, be aware of the three-year rule; if you pass away within three years of the transfer, the proceeds will still be subject to estate tax.

- Purchase a New Policy: Alternatively, the trustee can purchase a new policy on your life to avoid the three-year rule. You fund the trust, and the trustee pays the premiums.

Gift Tax Considerations

Transfers to an ILIT are considered taxable gifts. However, with proper administration, transfers up to $18,000 per beneficiary (as of 2024) can be excluded from federal gift tax under the annual gift tax exclusion. A Limro Health Professional can help

Crummey Withdrawal Rights

To qualify for the annual gift tax exclusion, beneficiaries must have Crummey withdrawal rights, allowing them a limited time to withdraw funds transferred to the trust. However, to fulfill the trust’s purpose, beneficiaries typically do not exercise these rights.

Responsibilities of an ILIT Trustee

The trustee’s duties include managing the trust’s finances, purchasing and maintaining life insurance policies, sending Crummey notices, and ultimately, distributing the trust assets according to its terms.

Considerations Before Implementing an ILIT

Implementing an ILIT involves navigating complex tax rules and regulations, along with upfront and ongoing administrative costs. It’s crucial to consult with an experienced estate planning professional to ensure this strategy aligns with your overall estate plan.

In conclusion, an ILIT can be a powerful tool in estate planning, offering a way to protect your life insurance proceeds from estate taxes and ensuring your family receives the full financial benefit you intended. With careful planning and professional guidance, an ILIT can be an essential part of securing your family’s financial future. Click to talk to a professional now!